Introduction to the Multi-Assets Collateral Mode for USDT-Margined Futures

- 重要公告

- 聯合保證金

HTX now supports Multi-Assets Collateral mode for USDT-margined futures. This offers traders greater flexibility and capital efficiency by allowing multiple assets, rather than just USDT as in the Single-Asset Collateral mode, to be used as collateral.

What is the Multi-Assets Collateral mode?

The Multi-Assets Collateral mode is a mechanism where a wider range of assets can be used as margin collateral for USDT-margined futures, helping users make better use of their portfolio without having to convert everything into USDT. Under this mode, the supported collateral assets contribute to your margin based on a certain ratio.

Please note the Multi-Assets Collateral mode is only available for cross margin.

In practice, when using non-USDT assets as collateral under the Multi-Assets Collateral mode, their value will be adjusted based on predefined ratios. Each supported asset has its specific ratio used to calculate its effective margin contribution.

Important Notes:

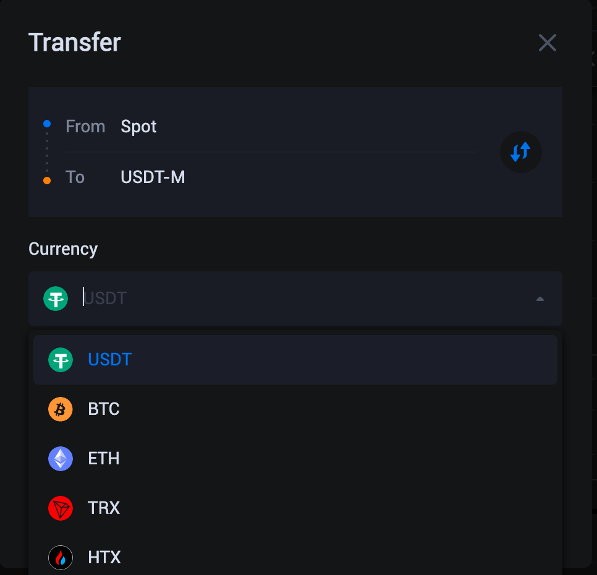

Transfer USDT, BTC, or ETH assets to your USDT-M Futures account before trading so that you can use them as collateral.

To reduce trading fees, please enable the TRX and HTX deduction features. Ensure that sufficient TRX and HTX tokens are transferred to your USDT-M Futures account.

The value of BTC, ETH, and other assets serving as collateral in the Multi-Assets Collateral mode is reduced by 5% to 10%.

For example, a $1,000 BTC asset with a 95% ratio would be valued at 950 USDT in the Multi-Assets Collateral mode.

How to use the Multi-Assets Collateral mode?

1. Enable the Multi-Assets Collateral mode on the USDT-M futures trading page.

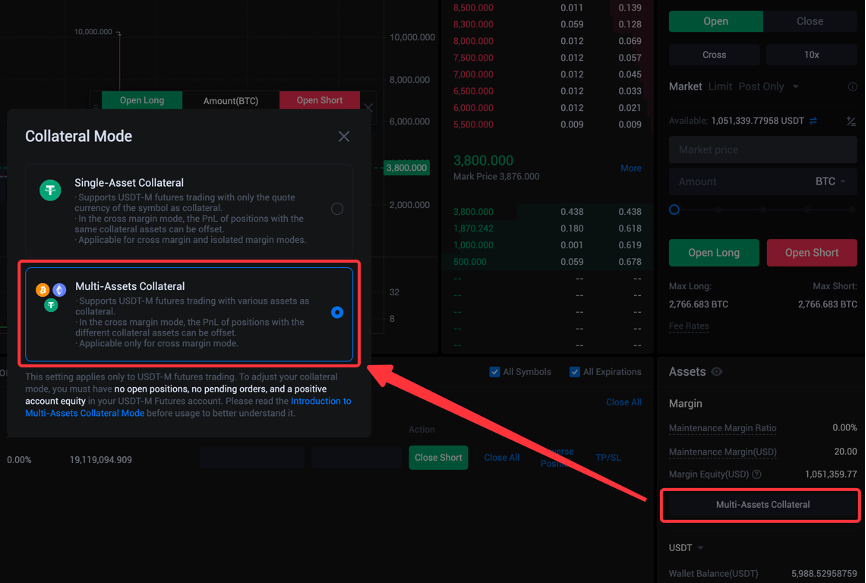

Web: Futures > USDT-M > Assets on the right side > enable the mode here.

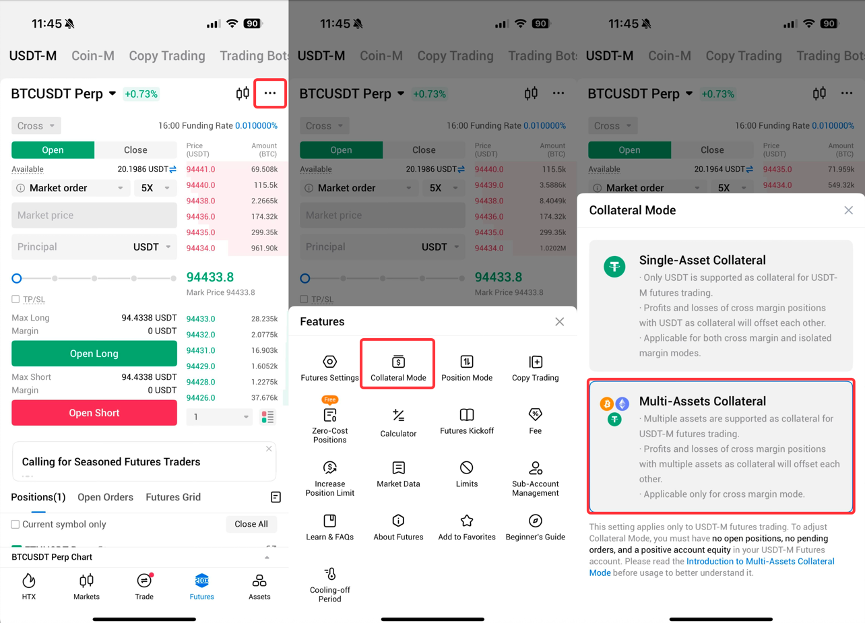

App: Tap [...] in the upper right corner, find Collateral Mode, and choose the Multi-Assets Collateral mode.

2. Transfer assets as collateral

Currently, the Multi-Assets Collateral mode supports USDT, BTC, and ETH as collateral assets. Any future additions will be announced in advance.

Order Cancelation by Risk Control System and Liquidation in Multi-Assets Collateral Mode

When an account’s initial margin ratio reaches or exceeds 100%, the system will trigger order cancelation due to risk control before proceeding to forced liquidation.

Order cancellation by the risk control system is a protective mechanism that activates when your account is assessed as risky but not risky enough to trigger forced liquidation. In this scenario, the system automatically cancels open orders to free up margin and lower the initial margin ratio below 100%. Once the account triggers the risk control order cancellation, opening new positions is disabled and only reduce-only orders are permitted.

Note: During the order cancellation by the risk control system, only assets used for trading fees can be withdrawn from your Futures account. Margin collateral withdrawals are not allowed. However, you can still deposit assets into your Futures account at any time during this period.

If the initial margin ratio remains higher than 100% after the order cancelation, and the maintenance margin ratio reaches or exceeds 100% due to market movements, the system will then trigger forced liquidation.

HTX Team

May 7, 2025

HTX社群

Facebook:https://www.facebook.com/HuobiChinese

Twitter:https://twitter.com/huobiglobal

Telegram:https://t.me/HTX_Chineseofficial

Reddit:https://www.reddit.com/r/HuobiGlobal/

Medium:https://htxofficial.medium.com/

Discord:https://discord.gg/htx-official

HTX保留可隨時根據任何原因修改、變更或取消此公告的所有權利,恕不另行通知。以上資訊內容僅供參考,HTX對本平台上的任何虛擬資產、產品或促銷活動不做任何推薦或保證。虛擬資產的價格波動較大,投資交易虛擬資產將面臨巨大風險,請詳閱此處的風險警示說明。